If you have traded in the forex market in the past or are still investing today, you may have heard the term trade broker many times. On the other hand, as a retail trader just starting out, you might want to learn more about Forex brokers and what they do. Forex brokers are individuals or agencies that help individual traders and companies when investing in the Forex market. In fact, they can give you the extra edge you need to be profitable in the Forex trading market. Although they exchange your funded account, all decisions remain yours if you so choose.

Forex brokers are there to help you with your trading needs in exchange for a small percentage of your earnings. The very first step in your successful trading is choosing a forex broker. Broker income and available information will not make this decision easier. Below you will find information on the basic problems you may encounter when choosing a forex broker and how to overcome these problems.

You cannot proceed without a forex broker and choosing the right broker is a must. Because of this, it is one of the most talked-about topics in Forex forums. Before you can start trading Forex, you need to set up an account with a broker. A broker is basically a broker, an individual or a company that buys and sells an order in agreement with a retailer.

With the large number of brokers offering their services online, you are probably feeling helpless and overwhelmed by a large amount of information that you may not know what to do with. And it is not easy to choose the right broker. There are thousands of brokers, from the solid and trustworthy to the crooked and dishonest, trying to rip off their clients. pepperstone broker, ActivTrades, Admiral Markets UK and others like this. You should take a look at the published instance and follow the advice to protect yourself from the latest marketing.

The broker is a necessary mediator between you and the market.Services like fast money transfer to and from it and a reliable platform should be standard for all above-average brokers.

They make little or no sense in the forex brokerage industry, and usually, the real interest of brokers using these terms is simply to enable you to trade forex as often as possible, whether or not you have money earned or lose.

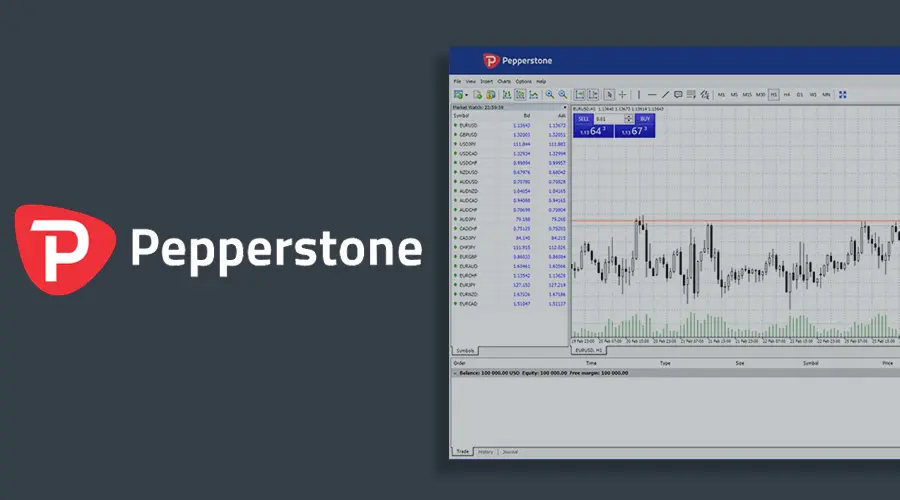

Pepperstone Broker:

Pepperstone is a leading forex broker that was established in 2010. It is owned by Pepperstone Group Limited and is headquartered in Melbourne, Australia.

Six years after its inception, its subsidiary, Pepperstone Limited, was launched with the goal of giving European merchants access to more advanced trading platforms and efficient customer service. With a long history of responsible behavior and local and international regulation, Pepperstone is a safe broker for UK residents to trade with.

Pepperstone broker clients can choose from MT4, MT5, and cTrader platforms, all of which have a mobile, desktop, and web versions. Pepperstone offers traders a perfect range of trading platforms. It continues to grow its market share thanks to competitive trading costs, fast trade executions and a balanced selection of assets.

Key Features

This broker presents an economic calendar that tells important events such as budget balance and any other data or economic indicators that can affect the market in any way. In the same calendar, they indicate the economic impact this could have worldwide: low, medium, or high. Pepperstone also has security alerts and dedicated security. They are designed to ensure that consumers are not scammed.

Fees and Other Commissions Deposits

Pepperstone does not impose a minimum deposit amount, but the broker recommends an initial deposit of 200 in your base currency. Payment methods include international bank transfers, electronic payments, Visa, and Master cards.

Withdrawals

There is a minimum withdrawal amount for international bank transfers, but the amount is not stated on the website. Otherwise, there is no minimum withdrawal. There are maximum withdrawals when using an electronic payment method, but you can withdraw as many times as you like. required.

Other

Pepperstone broker charges a conversion fee that starts at 0.4 pips. You will also have to pay an overnight fee if you decide to open a position after trading hours. The price depends on the size of the deal, the market price, and overnight rates.

Regulation and Security

Trading with a regulated broker limits the chances of scams and immorality. People always advise traders to check the regulation and check with the regulator by checking the license provided against their database. Pepperstone introduces customers to seven well-regulated audiences.

Features and Trading Platforms

Position Size

Pepperstone offers a maximum materialistic size of 100 lots and a minimum of 0.01 lots. For Razor accounts, the average EUR/USD spread is between 0.0 and 0.03 pips. On the standard account, it would be between 1.0 and 1.3 pips.

Permitted Techniques

As a forex broker, Pepperstone allows social trading, scalping, and impede. As a customer, you can use these strategies to try to maximize your profits.

Risk Management

Pepperstone offers risk management strategies to help you minimize risk when placing an order. You can then choose to use the market order to buy or sell at the best possible price.

Another tool available is the limit order. Here your trade will be processed when it reaches a confirmed price. You can also use warrants. Here you buy or sell as soon as the price exceeds a certain mark. This allows you to take advantage of a price fluctuation.

Platforms

Pepperstone offers MetaTrader4 and MetaTrader5 which you can download to your mobile, tablet, or computer for Mac and Windows.

pros

You have a good service for customers.

Low spreads.

Cons

They only offer Forex and CFDs.

US traders are not allowed.

Conclusion

Trading with Pepperstone is a very good overall experience due to the good prices, exceptionally low non-trading fees, and prompt and professional customer support should you need assistance.

Trading platforms are no exception, but they are large, intuitive and highly customizable. Additionally, Pepperstone has plenty of copy-sharing features, and you’ll likely find plenty of value in the company’s educational resource offerings.

On the other hand, the research resources could be much richer and the number of trading instruments is small compared to other top-rated brokers. However, despite these disadvantages, Pepperstone is a very popular platform and worth trying, especially if you are a trader from Australia.

Also Read: 5 Useful Suggestions to Buy Medical Equipment Online.

Contents